does idaho have capital gains tax

Wages salaries 100000 Capital gains - losses -50000. Right off the bat if you are single they will allow you to exclude 250000 of capital gains.

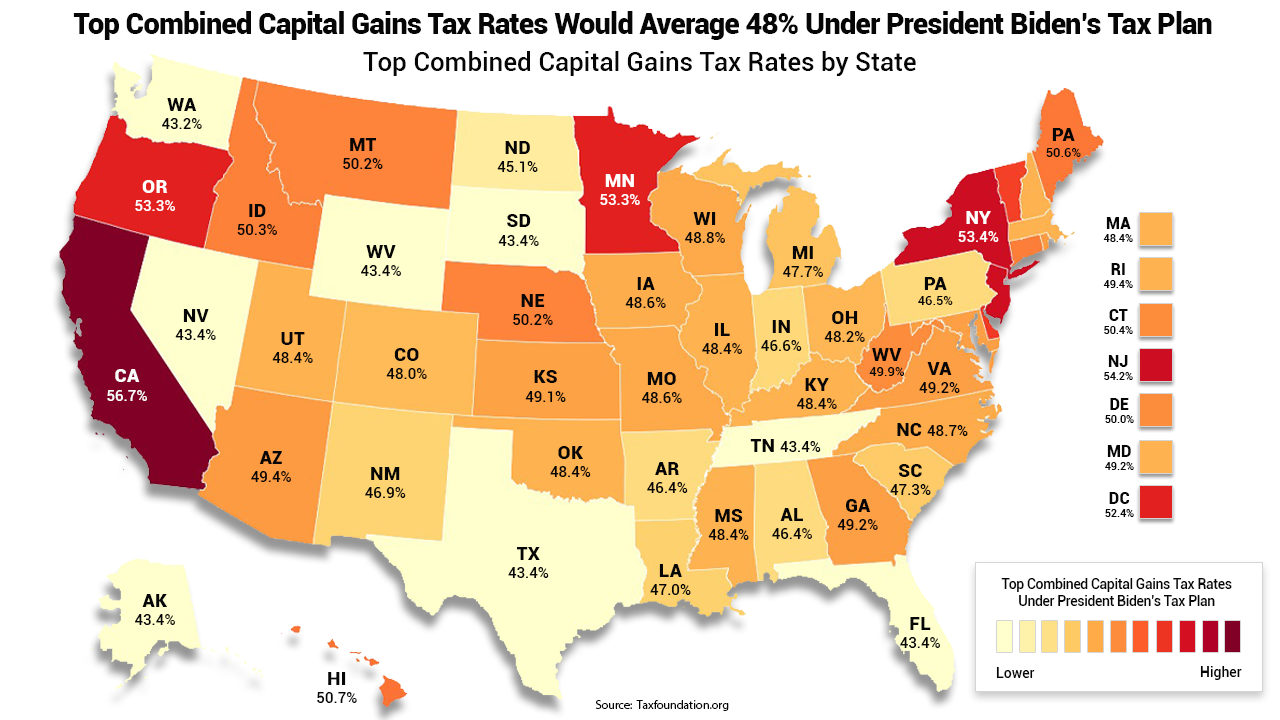

The High Burden Of State And Federal Capital Gains Tax Rates In The United States Tax Foundation

Does Idaho have an Inheritance Tax or an Estate Tax.

. However the state does not charge this capital gains tax on the sale of traditional currency no matter how much it might have inflated. Taxes Immigration Labor law Verified If you owned and used the property as a primary residence - the gain - up to 250000 for single. The Idaho Income Tax.

Idaho does not levy an inheritance tax or an estate tax. Idaho does not have a special tax rate for gains and losses on stocks bonds or other intangibles. The land in Utah cost 450000.

Delay the sale until after you retire 6. Does idaho have capital gains tax on. This is advised for traders making near 100k profits a.

One important thing to know about Idaho income taxes. Section 63-105 Idaho Code Powers and Duties - General Income Tax. The rates listed below are for 2022 which are taxes youll file in 2023.

Give the property to a family member 7. Precious metals in bullion form. The District of Columbia moved in the.

These would just be taxed as normal income. Sell the property at a loss 8. Idaho State Tax Commission.

The land in Idaho originally cost 550000. An LLC will be subject to corporate tax rate and allows you to claim all losses from trading as opposed to the 3k cap as a retail trader. Section 63-3039 Idaho Code Rules and Regulations Publication of Statistics.

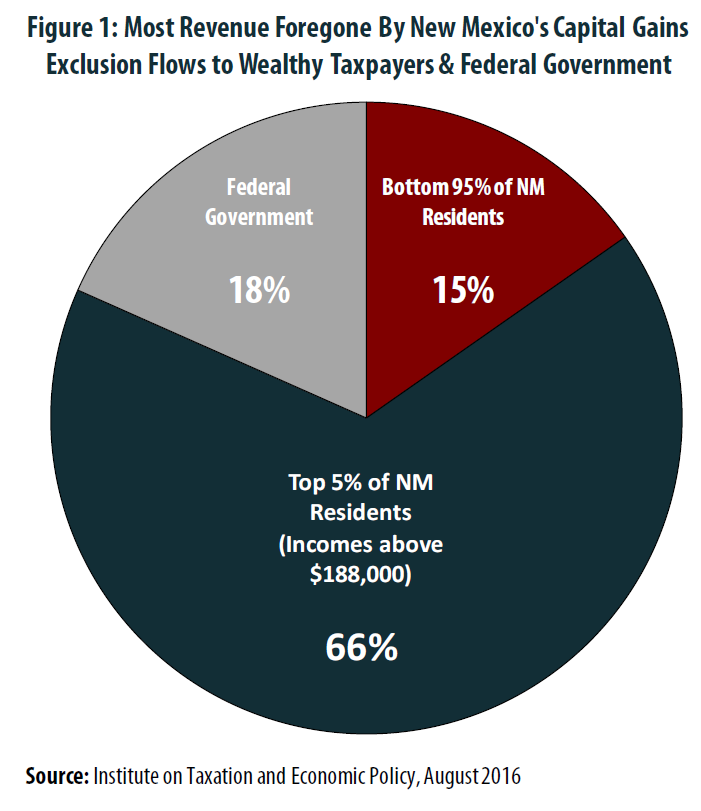

State Tax Commission PO. States have an additional capital gains tax rate between 29 and 133. If you found this answer helpful.

Roll over the capital gain into a superannuation fund 5. A majority of US. 208 334-7660 or 800 972-7660 Fax.

Section 63-3039 Idaho Code Rules and Regulations Publication of Statistics and Law Who do I contact for. Up to 15 cash back Experience. Mary must report 55000 of Idaho source income from the gain on the sale of the land computed.

Council Connection Lewis Introduces Progressive Revenue Plan For Permanent Supportive Housing

2021 Capital Gains Tax Rates By State

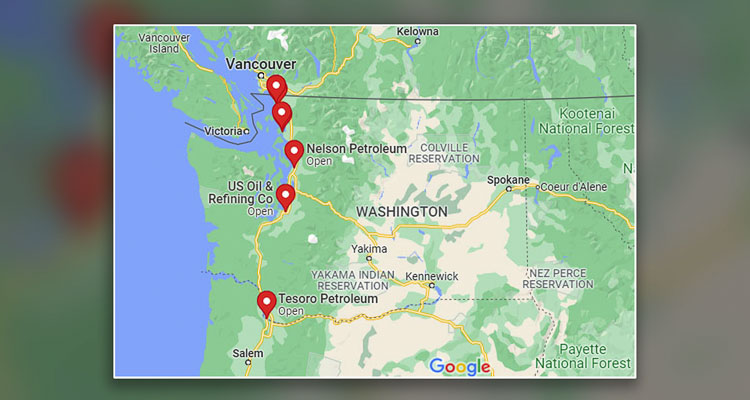

Challenge To Washington S Capital Gains Tax Can Move Forward Judge Rules The Seattle Times

Capital Gains Tax Idaho Can You Avoid It Selling A Home

The High Burden Of State And Federal Capital Gains Tax Rates In The United States Tax Foundation

The Ultimate Guide To Idaho Real Estate Taxes

Capital Gain Tax Rates By State 2021 2022 Calculate Cap Gains

Idaho State Taxes 2021 Income And Sales Tax Rates Bankrate

As Tax Gap Widens Idaho 1 Of 10 States With No Obligation To Disclose Property S Sale Price Idaho Capital Sun

Idaho Tax Rates Rankings Idaho State Taxes Tax Foundation

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Biden S Proposed Capital Gains Tax Hike Might Hit Wealthy Americans With 57 Rate Study Shows Fox Business

How High Are Capital Gains Taxes In Your State Tax Foundation

Is Washington Starting A Trade War With Oregon Alaska And Idaho Clarkcountytoday Com

A Programmer Tries To Figure Out How Capital Gains Tax Actually Works By Fpgaminer Hackernoon Com Medium

Idaho Qualified Small Business Stock Qsbs And Investor Tax Incentives Qsbs Expert

Capital Gains Tax Rates By State Nas Investment Solutions