is there a renters tax credit

How to get a copy of your tax transcript. While the rules vary from state to state there are a few things that remain somewhat consistent across state lines when it comes to eligibility for a renters tax credit.

5 Reasons Landlords Should Use Cozy British Sign Language Sign Language Chart Sign Language

The child tax credit for 2021 is up to 3600 for children under the.

. The mortgage interest deduction one of the main tax benefits for homeowners allows you to deduct the interest you pay on your mortgage to buy build or improve your main home or second home. Since the length of your credit history accounts for 15 of your credit score negative minimal or no credit history can stop you from reaching an 800 credit score. The 15000 First-Time Home Buyer Tax Credit has precedent which makes it the most likely first-time buyer program to pass Congress.

Increases the 30 match of the federal credit to 40. With the Individual Income Property Tax credit Washington DC offers renters with a household income of 20000 or less a. The first-time home buyer tax credit is automatically for eligible home buyers.

Basic baseline requirements often include. Boosts the cap which is based on 50 of rent paid from 3000 to 4000. There were several tax law changes in 2021 which will affect most Americans this coming tax season.

The bill for first-time buyers is modeled on the 8000 First-Time Home Buyer Tax Credit from the 2008 Housing and Economic Recovery Act. To solve this problem focus. You can deduct the interest paid on up to 750000 of mortgage debt if youre an individual taxpayer or a married couple filing a joint tax.

You might need a copy of your old tax return rather than a tax transcript if more-detailed information from prior tax returns like the specific W-2s you filed is required or if older tax information is needed. There are three ways to get a copy of your tax transcript. Earned income tax credit.

Property Detective A Checklist For Renters Infographic Renter Finance Infographic Real Estate Infographic

New Tenant Welcome Letter Pdf Property Management Welcome Letters Being A Landlord

Claiming Expenses On Rental Properties 2022 Turbotax Canada Tips

Claiming Rent On Taxes Rent Tax Return Canada Accountor Cpa Taxation Blog

Here Are The States That Provide A Renter S Tax Credit Rent Blog

Eviction Records Can Help Landlords Ensure That They Only Rent To The Best Possible Tenants Tenant Background Check Rental Background Check Tenant Screening

What Is A Good Credit Score For Renting A Home

Balderdash A Renters Tax Credit Will Only Worsen Housing Affordability Niskanen Center

Claiming Expenses On Rental Properties 2022 Turbotax Canada Tips

Security Check Required Selling House Home Buying Tips Real Estate Infographic

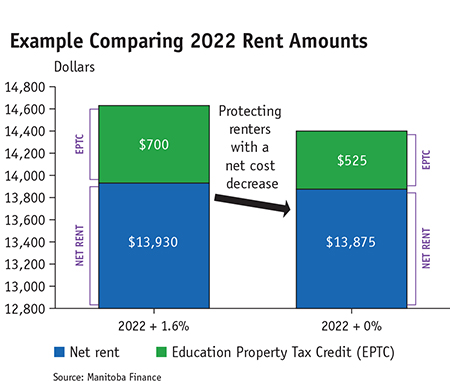

Provincial Education Property Tax Rebate Roll Out Rural Municipality Of St Clements

Vacation Rental Apartment Rental Rental Living Rental Tips Rental House House Rental Home Rent Rental Income Rental Property Management Rental Apartments

Encouraged In Order To Our Weblog In This Particular Period We Ll Demonstrate About Free Printable Rental Agreement Templates Lease Agreement Being A Landlord

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

Cozy Helps Landlords And Tenants With Fast Credit Checks Background And Eviction Checks Free Online Rent Tenant Screening Being A Landlord Renters Insurance

Pin By Danielle Roy On Essentials In 2022 Tax Prep Social Security Card Tax Return

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

Everything Ontario Landlords Need To Know About Tax Deductions Liv Rent Blog

Free Property Management Software Online Rent Collection Renters Insurance Tenant Screenin Rental Property Management Renters Insurance Property Management